000182323912/312021Q1FALSEP2YP12Y2.500018232392021-01-012021-03-31xbrli:shares0001823239us-gaap:CommonClassAMember2021-05-070001823239us-gaap:CommonClassBMember2021-05-07iso4217:USD00018232392021-03-3100018232392020-12-31iso4217:USDxbrli:shares0001823239us-gaap:CommonClassAMember2020-12-310001823239us-gaap:CommonClassAMember2021-03-310001823239us-gaap:CommonClassBMember2021-03-310001823239us-gaap:CommonClassBMember2020-12-3100018232392020-01-012020-03-310001823239us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310001823239us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001823239us-gaap:AdditionalPaidInCapitalMember2020-12-310001823239us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001823239us-gaap:RetainedEarningsMember2020-12-310001823239us-gaap:NoncontrollingInterestMember2020-12-310001823239us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001823239us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001823239us-gaap:RetainedEarningsMember2021-01-012021-03-310001823239us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001823239us-gaap:CommonClassAMemberus-gaap:CommonStockMember2021-03-310001823239us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-03-310001823239us-gaap:AdditionalPaidInCapitalMember2021-03-310001823239us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001823239us-gaap:RetainedEarningsMember2021-03-310001823239us-gaap:NoncontrollingInterestMember2021-03-310001823239us-gaap:MemberUnitsMember2019-12-310001823239us-gaap:AdditionalPaidInCapitalMember2019-12-310001823239us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001823239us-gaap:RetainedEarningsMember2019-12-310001823239us-gaap:NoncontrollingInterestMember2019-12-3100018232392019-12-310001823239us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001823239us-gaap:NoncontrollingInterestMember2020-01-012020-03-310001823239us-gaap:RetainedEarningsMember2020-01-012020-03-310001823239us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001823239us-gaap:MemberUnitsMember2020-03-310001823239us-gaap:AdditionalPaidInCapitalMember2020-03-310001823239us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001823239us-gaap:RetainedEarningsMember2020-03-310001823239us-gaap:NoncontrollingInterestMember2020-03-3100018232392020-03-31mrvi:segment0001823239us-gaap:IPOMember2020-11-012020-11-300001823239us-gaap:IPOMember2020-11-300001823239srt:NorthAmericaMembermrvi:NucleicAcidProductionSegmentMember2021-01-012021-03-310001823239srt:NorthAmericaMembermrvi:BiologicsSafetyTestingSegmentMember2021-01-012021-03-310001823239srt:NorthAmericaMembermrvi:ProteinDetectionSegmentMember2021-01-012021-03-310001823239srt:NorthAmericaMember2021-01-012021-03-310001823239mrvi:NucleicAcidProductionSegmentMemberus-gaap:EMEAMember2021-01-012021-03-310001823239mrvi:BiologicsSafetyTestingSegmentMemberus-gaap:EMEAMember2021-01-012021-03-310001823239mrvi:ProteinDetectionSegmentMemberus-gaap:EMEAMember2021-01-012021-03-310001823239us-gaap:EMEAMember2021-01-012021-03-310001823239mrvi:NucleicAcidProductionSegmentMembersrt:AsiaPacificMember2021-01-012021-03-310001823239srt:AsiaPacificMembermrvi:BiologicsSafetyTestingSegmentMember2021-01-012021-03-310001823239mrvi:ProteinDetectionSegmentMembersrt:AsiaPacificMember2021-01-012021-03-310001823239srt:AsiaPacificMember2021-01-012021-03-310001823239mrvi:NucleicAcidProductionSegmentMembermrvi:LatinAndCentralAmericaMember2021-01-012021-03-310001823239mrvi:BiologicsSafetyTestingSegmentMembermrvi:LatinAndCentralAmericaMember2021-01-012021-03-310001823239mrvi:ProteinDetectionSegmentMembermrvi:LatinAndCentralAmericaMember2021-01-012021-03-310001823239mrvi:LatinAndCentralAmericaMember2021-01-012021-03-310001823239mrvi:NucleicAcidProductionSegmentMember2021-01-012021-03-310001823239mrvi:BiologicsSafetyTestingSegmentMember2021-01-012021-03-310001823239mrvi:ProteinDetectionSegmentMember2021-01-012021-03-310001823239srt:NorthAmericaMembermrvi:NucleicAcidProductionSegmentMember2020-01-012020-03-310001823239srt:NorthAmericaMembermrvi:BiologicsSafetyTestingSegmentMember2020-01-012020-03-310001823239srt:NorthAmericaMembermrvi:ProteinDetectionSegmentMember2020-01-012020-03-310001823239srt:NorthAmericaMember2020-01-012020-03-310001823239mrvi:NucleicAcidProductionSegmentMemberus-gaap:EMEAMember2020-01-012020-03-310001823239mrvi:BiologicsSafetyTestingSegmentMemberus-gaap:EMEAMember2020-01-012020-03-310001823239mrvi:ProteinDetectionSegmentMemberus-gaap:EMEAMember2020-01-012020-03-310001823239us-gaap:EMEAMember2020-01-012020-03-310001823239mrvi:NucleicAcidProductionSegmentMembersrt:AsiaPacificMember2020-01-012020-03-310001823239srt:AsiaPacificMembermrvi:BiologicsSafetyTestingSegmentMember2020-01-012020-03-310001823239mrvi:ProteinDetectionSegmentMembersrt:AsiaPacificMember2020-01-012020-03-310001823239srt:AsiaPacificMember2020-01-012020-03-310001823239mrvi:NucleicAcidProductionSegmentMembermrvi:LatinAndCentralAmericaMember2020-01-012020-03-310001823239mrvi:BiologicsSafetyTestingSegmentMembermrvi:LatinAndCentralAmericaMember2020-01-012020-03-310001823239mrvi:ProteinDetectionSegmentMembermrvi:LatinAndCentralAmericaMember2020-01-012020-03-310001823239mrvi:LatinAndCentralAmericaMember2020-01-012020-03-310001823239mrvi:NucleicAcidProductionSegmentMember2020-01-012020-03-310001823239mrvi:BiologicsSafetyTestingSegmentMember2020-01-012020-03-310001823239mrvi:ProteinDetectionSegmentMember2020-01-012020-03-310001823239us-gaap:TransferredAtPointInTimeMember2021-01-012021-03-310001823239us-gaap:TransferredAtPointInTimeMember2020-01-012020-03-310001823239us-gaap:TransferredOverTimeMember2021-01-012021-03-310001823239us-gaap:TransferredOverTimeMember2020-01-012020-03-31xbrli:pure0001823239mrvi:MLSCHoldingsLLCMembermrvi:MaravaiTopcoHoldingsLLCMember2020-10-310001823239mrvi:MLSCHoldingsLLCMember2020-10-310001823239mrvi:MLSCHoldingsLLCMembermrvi:MaravaiTopcoHoldingsLLCMember2020-11-012020-11-300001823239mrvi:MaravaiTopcoHoldingsLLCMember2020-11-300001823239mrvi:MaravaiTopcoHoldingsLLCMembermrvi:MaravaiLifeSciencesHoldingsLLCMember2020-11-300001823239mrvi:TaxDistributionMembermrvi:MaravaiTopcoHoldingsLLCMembermrvi:MaravaiLifeSciencesHoldingsLLCMember2021-01-012021-03-310001823239mrvi:TaxDistributionMembermrvi:MaravaiTopcoHoldingsLLCMembermrvi:MaravaiLifeSciencesHoldingsLLCMember2020-01-012020-03-310001823239mrvi:BioNTechSEMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-03-310001823239mrvi:BioNTechSEMembermrvi:AccountsReceivableBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-03-310001823239mrvi:PfizerIncMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-03-310001823239mrvi:PfizerIncMembermrvi:AccountsReceivableBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-03-310001823239mrvi:PfizerIncMembermrvi:AccountsReceivableBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001823239mrvi:SanofiMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-03-310001823239mrvi:AccountsReceivableBenchmarkMembermrvi:CureVacMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-31mrvi:reportingUnit0001823239mrvi:NucleicAcidProductionSegmentMember2021-03-310001823239mrvi:BiologicsSafetyTestingSegmentMember2021-03-310001823239mrvi:ProteinDetectionSegmentMember2021-03-310001823239mrvi:NucleicAcidProductionSegmentMember2020-12-310001823239mrvi:BiologicsSafetyTestingSegmentMember2020-12-310001823239mrvi:ProteinDetectionSegmentMember2020-12-310001823239srt:MinimumMember2021-01-012021-03-310001823239srt:MaximumMember2021-01-012021-03-310001823239us-gaap:TradeNamesMember2021-03-310001823239srt:MinimumMemberus-gaap:TradeNamesMember2021-01-012021-03-310001823239srt:MaximumMemberus-gaap:TradeNamesMember2021-01-012021-03-310001823239us-gaap:TradeNamesMember2021-01-012021-03-310001823239us-gaap:TechnologyBasedIntangibleAssetsMember2021-03-310001823239srt:MinimumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-03-310001823239srt:MaximumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-03-310001823239us-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-03-310001823239us-gaap:CustomerRelationshipsMember2021-03-310001823239srt:MinimumMemberus-gaap:CustomerRelationshipsMember2021-01-012021-03-310001823239srt:MaximumMemberus-gaap:CustomerRelationshipsMember2021-01-012021-03-310001823239us-gaap:CustomerRelationshipsMember2021-01-012021-03-310001823239us-gaap:TradeNamesMember2020-12-310001823239srt:MinimumMemberus-gaap:TradeNamesMember2020-01-012020-12-310001823239srt:MaximumMemberus-gaap:TradeNamesMember2020-01-012020-12-310001823239us-gaap:TradeNamesMember2020-01-012020-12-310001823239us-gaap:TechnologyBasedIntangibleAssetsMember2020-12-310001823239srt:MinimumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2020-01-012020-12-310001823239srt:MaximumMemberus-gaap:TechnologyBasedIntangibleAssetsMember2020-01-012020-12-310001823239us-gaap:TechnologyBasedIntangibleAssetsMember2020-01-012020-12-310001823239us-gaap:CustomerRelationshipsMember2020-12-310001823239srt:MinimumMemberus-gaap:CustomerRelationshipsMember2020-01-012020-12-310001823239srt:MaximumMemberus-gaap:CustomerRelationshipsMember2020-01-012020-12-310001823239us-gaap:CustomerRelationshipsMember2020-01-012020-12-3100018232392020-01-012020-12-310001823239us-gaap:CostOfSalesMember2020-01-012020-03-310001823239us-gaap:CostOfSalesMember2021-01-012021-03-310001823239us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-03-310001823239us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-03-310001823239srt:MinimumMember2021-03-310001823239srt:MaximumMember2021-03-310001823239mrvi:LeasesWithMultipleFiveYearRenewalTermsMember2021-03-310001823239mrvi:LeasesWithThreeYearRenewalTermsMember2021-03-310001823239mrvi:LeasesWithFiveYearRenewalTermsMember2021-03-310001823239mrvi:BurlingameCaliforniaMember2021-01-012021-03-310001823239mrvi:BurlingameCaliforniaMember2020-01-012020-03-3100018232392020-01-012020-01-310001823239mrvi:BurlingameCaliforniaMember2020-01-310001823239mrvi:January2020LeaseAgreementMembermrvi:BurlingameCaliforniaMember2020-01-012020-03-310001823239mrvi:BurlingameCaliforniaMember2020-08-012020-08-310001823239mrvi:BurlingameCaliforniaMember2020-08-310001823239mrvi:SanDiegoMember2018-07-310001823239mrvi:SanDiegoMember2020-09-300001823239mrvi:SanDiegoMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001823239us-gaap:ConstructionInProgressMembermrvi:SanDiegoMember2020-12-310001823239mrvi:SanDiegoMember2020-12-310001823239mrvi:SanDiegoMember2021-01-012021-03-310001823239mrvi:BuildingLeaseholdImprovementsAndEquipmentMember2021-01-012021-03-310001823239us-gaap:ConstructionInProgressMember2021-01-012021-03-310001823239mrvi:SanDiegoMember2020-01-012020-03-310001823239us-gaap:LeaseholdsAndLeaseholdImprovementsMembermrvi:SouthportNorthCarolinaMember2021-01-012021-03-3100018232392020-10-310001823239mrvi:NewCreditAgreementMemberus-gaap:LineOfCreditMember2020-10-310001823239mrvi:NewCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2020-10-310001823239mrvi:NewCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-10-3100018232392020-11-012020-11-300001823239mrvi:NewCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2021-03-310001823239mrvi:NewCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2020-10-310001823239us-gaap:InterestRateCapMember2021-03-310001823239mrvi:NewCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2020-12-310001823239mrvi:NewCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2021-03-310001823239us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-03-310001823239us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-03-310001823239us-gaap:PerformanceSharesMember2021-03-310001823239us-gaap:RestrictedStockUnitsRSUMember2021-03-310001823239us-gaap:EmployeeStockOptionMember2021-01-012021-03-310001823239us-gaap:PerformanceSharesMember2021-01-012021-03-310001823239us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-03-310001823239us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-03-310001823239us-gaap:EmployeeStockMember2021-01-012021-03-310001823239us-gaap:EmployeeStockMember2020-01-012020-03-310001823239mrvi:TimeBasedIncentiveUnitsMember2021-01-012021-03-310001823239mrvi:TimeBasedIncentiveUnitsMember2020-01-012020-03-310001823239mrvi:PerformanceBasedIncentiveUnitsMember2021-01-012021-03-310001823239mrvi:PerformanceBasedIncentiveUnitsMember2020-01-012020-03-310001823239us-gaap:EmployeeStockOptionMember2021-01-012021-03-310001823239us-gaap:EmployeeStockOptionMember2020-01-012020-03-310001823239us-gaap:CommonClassBMember2021-01-012021-03-310001823239us-gaap:CommonClassBMember2020-01-012020-03-310001823239mrvi:TaxDistributionMembermrvi:MaravaiTopcoHoldingsLLCMember2021-01-012021-03-310001823239mrvi:MaravaiLifeSciencesHoldingsIncMembermrvi:TaxDistributionMembermrvi:MaravaiTopcoHoldingsLLCMember2021-01-012021-03-310001823239srt:AffiliatedEntityMembermrvi:AdvisoryServicesAgreementQuarterlyManagementFeeMember2021-01-012021-03-310001823239srt:AffiliatedEntityMembermrvi:AdvisoryServicesAgreementManagementFeesMember2020-01-012020-03-310001823239srt:AffiliatedEntityMembermrvi:LeasePaymentsMember2020-01-012020-03-310001823239srt:AffiliatedEntityMembermrvi:TaxReceivableAgreementPaymentsMember2021-01-012021-03-310001823239mrvi:NucleicAcidProductionSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001823239mrvi:BiologicsSafetyTestingSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001823239mrvi:ProteinDetectionSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-03-310001823239us-gaap:CorporateNonSegmentMember2021-01-012021-03-310001823239us-gaap:IntersegmentEliminationMember2021-01-012021-03-310001823239mrvi:NucleicAcidProductionSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001823239mrvi:BiologicsSafetyTestingSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001823239mrvi:ProteinDetectionSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001823239us-gaap:CorporateNonSegmentMember2020-01-012020-03-310001823239us-gaap:IntersegmentEliminationMember2020-01-012020-03-310001823239us-gaap:SubsequentEventMembermrvi:SecondaryOfferingMember2021-04-122021-04-120001823239us-gaap:SubsequentEventMemberus-gaap:OverAllotmentOptionMember2021-04-122021-04-120001823239us-gaap:SubsequentEventMemberus-gaap:OverAllotmentOptionMember2021-04-120001823239us-gaap:SubsequentEventMembermrvi:MaravaiLifeSciencesHoldingsLLCMembermrvi:SecondaryOfferingMember2021-04-122021-04-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-39725

Maravai LifeSciences Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 8731 | | 85-2786970 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification No.) |

______________________________

10770 Wateridge Circle Suite 200

San Diego, California 92121

(Address of principal executive offices)

Registrant’s telephone number, including area code: (858) 546-0004

______________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.01 par value | | MRVI | | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | ý | Smaller reporting company | o |

| | Emerging growth company | ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

As of May 7, 2021, 114,351,371 shares of the registrant’s Class A common stock were outstanding and 143,308,170 shares of the registrant’s Class B common stock were outstanding.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENT

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. All statements other than statements of historical fact included in this report are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

•our history of losses, the risk that we may continue to incur losses in the future and our ability to generate sufficient revenue to achieve or maintain profitability;

•the fluctuation of our operating results, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide;

•our dependence on a limited number of customers for a high percentage of our revenue;

•the use of certain of our products in the production of vaccines and therapies that represent relatively new and still-developing modes of treatment, which may experience unforeseen adverse events, negative clinical outcomes or increased regulatory scrutiny;

•the impact of COVID-19 and any pandemic, epidemic or outbreak of infectious disease;

•changes in economic conditions;

•our dependence on customers’ spending on and demand for outsourced nucleic acid production, biologics safety testing and protein detection research products and services;

•competition with life science, pharmaceutical and biotechnology companies who are substantially larger than we are and potentially capable of developing new approaches that could make our products, services and technologies obsolete;

•the ability of our products and services to perform as expected and the reliability of the technology on which our products and services are based;

•the complexity of our products and the fact that they are subject to quality control requirements;

•our reliance on a limited number of suppliers or, in some cases, sole suppliers, for some of our raw materials and our inability to find replacements or immediately transition to alternative suppliers;

•our dependence on a stable and adequate supply of quality raw materials from our suppliers, and the risk of adverse impacts from price increases or interruptions of such supply;

•disruptions at our sites;

•our ability to manufacture in specific quantities;

•natural disasters, geopolitical unrest, war, terrorism, public health issues such as COVID-19 or other catastrophic events that could disrupt the supply, delivery or demand of products and services;

•our ability to secure additional financing for future strategic transactions;

•our reliance on third-party package delivery services and adverse impacts arising from significant disruptions of these services, damages or losses sustained during shipping or significant increases in prices;

•our ability to continue to hire and retain skilled personnel;

•our ability to successfully identify and implement distribution arrangements and marketing alliances;

•the market acceptance of our life science reagents;

•the market receptivity to our new products and services upon their introduction;

•our ability to implement our strategies for revenue growth;

•the accuracy of our estimates of market opportunity and forecasts of market growth;

•product liability lawsuits;

•the application of privacy laws, security laws, regulations, policies and contractual obligations related to data privacy and security;

•our ability to efficiently manage our growth;

•the success of any opportunistic acquisitions;

•the integrity of our internal computer systems;

•the impact of export and import control laws and regulations;

•risks related to Brexit;

•changes in political, economic or governmental regulations;

•financial, operating, legal and compliance risks associated with global operations;

•risks associated with our acquisitions;

•impacts from foreign currency exchange rates;

•the risk that our products could become subject to more onerous regulation in the future;

•our ability to use net operating loss and tax credit carryforwards;

•the fact that our activities are and will continue to be subject to extensive government regulation;

•the risk that we may be required to record a significant charge to earnings if our goodwill or other amortizable intangible assets become impaired;

•unfavorable accounting charges or effects driven by changes in accounting principles or guidance;

•impacts on our financial results from our revenue recognition and other factors;

•fluctuations in our effective tax rate;

•environmental risks;

•our ability to obtain, maintain and enforce intellectual property protection for our current and future products;

•our ability to protect the confidentiality of our proprietary information;

•risks associated with lawsuits to protect our patents or with respect to the infringement, misappropriations or other violations of intellectual property rights of third parties;

•risks associated with failures to comply with our obligations under license agreements;

•potential changes in patent law in the United States and other jurisdictions;

•our ability to obtain and maintain our patent protection;

•impact of claims by third parties that we or our employees, consultants or independent contractors have infringed, misappropriated or otherwise violated their intellectual property;

•our ability to protect our intellectual property and proprietary rights throughout the world;

•our reliance on confidentiality agreements;

•our ability to protect our trademarks and trade names;

•threats not related to intellectual property; and

•other risks addressed in our Annual Report on Form 10-K for the year ended December 31, 2020.

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based on many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the section entitled

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Quarterly Report on Form 10-Q.

The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Part I.

Item 1. Financial Statements and Supplementary Data

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share amounts and par value)

(Unaudited)

| | | | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 | | |

| Assets | | | | | |

| Current assets: | | | | | |

| Cash | $ | 247,675 | | | $ | 236,184 | | | |

| Accounts receivable, net | 121,821 | | | 51,018 | | | |

| Inventory | 47,129 | | | 33,301 | | | |

| Prepaid expenses and other current assets | 8,918 | | | 11,095 | | | |

| Total current assets | 425,543 | | | 331,598 | | | |

| Property and equipment, net | 105,133 | | | 101,305 | | | |

| Goodwill | 224,275 | | | 224,275 | | | |

| Intangible assets, net | 172,616 | | | 177,656 | | | |

| Deferred tax assets | 419,901 | | | 431,699 | | | |

| Other assets | 4,300 | | | 4,158 | | | |

| Total assets | $ | 1,351,768 | | | $ | 1,270,691 | | | |

| Liabilities and stockholders' equity | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | $ | 9,806 | | | $ | 8,171 | | | |

| Accrued expenses and other current liabilities | 28,973 | | | 38,546 | | | |

| Deferred revenue | 119,175 | | | 78,061 | | | |

| Current portion of payable to related parties pursuant to Tax Receivable Agreement | 1,298 | | | — | | | |

| Current portion of long-term debt | 6,000 | | | 6,000 | | | |

| Total current liabilities | 165,252 | | | 130,778 | | | |

| Long-term debt, less current portion | 527,593 | | | 528,614 | | | |

| Deferred tax liabilities | 8,571 | | | 8,609 | | | |

| Lease facility financing obligation, less current portion | 55,924 | | | 56,167 | | | |

| Payable to related parties pursuant to a Tax Receivable Agreement | 382,362 | | | 389,546 | | | |

| Other long-term liabilities | 2,310 | | | 2,231 | | | |

| Total liabilities | 1,142,012 | | | 1,115,945 | | | |

| Lease commitments (Note 5) | | | | | |

| Stockholders' equity | | | | | |

Class A common stock, $0.01 par value - 500,000,000 shares authorized; 96,646,515 shares issued and outstanding as of March 31, 2021 and December 31, 2020 | 966 | | | 966 | | | |

Class B common stock, $0.01 par value - 300,000,000 shares authorized; 160,974,129 shares issued and outstanding as of March 31, 2021 and December 31, 2020 | 1,610 | | | 1,610 | | | |

| Additional paid-in capital | 85,976 | | | 85,125 | | | |

| Accumulated other comprehensive loss | (42) | | | (44) | | | |

| Retained earnings | 24,101 | | | 854 | | | |

| Total stockholders' equity attributable to Maravai LifeSciences Holdings, Inc. | 112,611 | | | 88,511 | | | |

| Non-controlling interests | 97,145 | | | 66,235 | | | |

| Total stockholders' equity | 209,756 | | | 154,746 | | | |

| Total liabilities and stockholders' equity | $ | 1,351,768 | | | $ | 1,270,691 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except share and unit amounts and per share and per unit amounts)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| | | |

| Revenue | $ | 148,211 | | | $ | 50,981 | |

| Operating expenses: | | | |

| Cost of revenue | 30,368 | | | 15,297 | |

| Research and development | 2,164 | | | 3,744 | |

| Selling, general and administrative | 23,237 | | | 16,126 | |

| | | |

| Gain on sale and leaseback transaction | — | | | (19,002) | |

| Total operating expenses | 55,769 | | | 16,165 | |

| Income from operations | 92,442 | | | 34,816 | |

| Other income (expense): | | | |

| Interest expense | (8,770) | | | (7,382) | |

| Change in payable to related parties pursuant to a Tax Receivable Agreement | 5,886 | | | — | |

| Other income | 3 | | | 80 | |

| Income before income taxes | 89,561 | | | 27,514 | |

| Income tax expense | 13,709 | | | 3,635 | |

| Net income | 75,852 | | | 23,879 | |

| Net income attributable to non-controlling interests | 52,605 | | | 490 | |

| Net income attributable to Maravai LifeSciences Holdings, Inc. | $ | 23,247 | | | $ | 23,389 | |

| | | |

| Net income per Class A common share/unit attributable to Maravai LifeSciences Holdings, Inc.: | | | |

| Basic | $ | 0.24 | | | $ | 0.09 | |

| Diluted | $ | 0.24 | | | $ | 0.09 | |

| | | |

| Weighted average number of Class A common shares/units outstanding: | | | |

| Basic | 96,646,515 | | | 253,916,941 | |

| Diluted | 96,672,968 | | | 253,916,941 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| March 31, 2021 | | March 31, 2020 |

| Net income | $ | 75,852 | | | $ | 23,879 | |

| Other comprehensive income: | | | |

| Foreign currency translation adjustments | 8 | | | (71) | |

| Total other comprehensive income | 75,860 | | | 23,808 | |

| Comprehensive income attributable to non-controlling interests | 52,605 | | | 490 | |

| Total comprehensive income attributable to Maravai LifeSciences Holdings, Inc. | $ | 23,255 | | | $ | 23,318 | |

The accompanying notes are an integral part of the condensed consolidated financial statements

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’/MEMBER’S EQUITY

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common Stock | | Class B Common Stock | | | | | | | | | | |

| Shares | | Amount | | Shares | | Amount | | Additional Paid In Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Non-Controlling Interest | | Total Stockholders'/Member's Equity |

| December 31, 2020 | 96,647 | | $ | 966 | | | 160,974 | | $ | 1,610 | | | $ | 85,125 | | | $ | (44) | | | $ | 854 | | | $ | 66,235 | | | $ | 154,746 | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 854 | | | — | | | — | | | 1,424 | | | 2,278 | |

| Distribution for tax liabilities to non-controlling interest holder | — | | | — | | | — | | | — | | | (3) | | | — | | | — | | | (23,125) | | | (23,128) | |

| Net income | — | | — | | | — | | — | | | — | | — | | | 23,247 | | | 52,605 | | | 75,852 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | — | | | 2 | | | — | | | 6 | | | 8 | |

| March 31, 2021 | 96,647 | | $ | 966 | | | 160,974 | | $ | 1,610 | | | $ | 85,976 | | | $ | (42) | | | $ | 24,101 | | | $ | 97,145 | | | $ | 209,756 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Units | | Amount | | Contributed Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Non-Controlling Interest | | Total Member's Equity |

| December 31, 2019 | 253,917 | | $0 | | $183,910 | | $ | (133) | | | $ | (42,381) | | | $ | 3,231 | | | $ | 144,627 | |

| Unit-based compensation | — | | — | | 420 | | — | | | — | | | 88 | | | 508 | |

| Net income | — | | — | | — | | — | | | 23,389 | | | 490 | | | 23,879 | |

| Foreign currency translation adjustment | — | | — | | — | | (71) | | | — | | | — | | | (71) | |

| March 31, 2020 | 253,917 | | $ | — | | | $ | 184,330 | | | $ | (204) | | | $ | (18,992) | | | $ | 3,809 | | | $ | 168,943 | |

The accompanying notes are an integral part of the condensed consolidated financial statements

MARAVAI LIFESCIENCES HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2021 | | 2020 |

| Operating activities | | | |

| Net income | $ | 75,852 | | | $ | 23,879 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 1,854 | | | 1,691 | |

| Amortization of intangible assets | 5,040 | | | 5,075 | |

| Amortization of deferred financing costs | 654 | | | 431 | |

| Equity-based compensation expense | 2,278 | | | 508 | |

| Deferred income taxes | 11,760 | | | (1,274) | |

| Gain on sale and leaseback transaction | — | | | (19,002) | |

| Acquired and in-process research and development costs | — | | | 2,881 | |

| Non-cash interest expense recognized on lease facility financing obligation | 162 | | | 215 | |

| Revaluation of liabilities under Tax Receivable Agreement | (5,886) | | | — | |

| Other | (144) | | | 38 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (70,812) | | | (10,086) | |

| Inventory | (13,828) | | | (5,365) | |

| Prepaid expenses and other assets | 98 | | | 209 | |

| Accounts payable | 1,897 | | | 3,402 | |

| Accrued expenses and other current liabilities | (11,044) | | | 9,044 | |

| Other long-term liabilities | (280) | | | (1,925) | |

| Deferred revenue | 41,114 | | | (8) | |

| Net cash provided by operating activities | 38,715 | | | 9,713 | |

| Investing activities | | | |

| Cash paid for asset acquisition, net of cash acquired | — | | | (3,024) | |

| Purchases of property and equipment | (3,580) | | | (3,409) | |

| Proceeds from sale of building | 548 | | | 34,500 | |

| Net cash (used in) provided by investing activities | (3,032) | | | 28,067 | |

| Financing activities | | | |

| Distributions for tax liabilities to non-controlling interests holders | (23,128) | | | — | |

| Proceeds from borrowings of long-term debt, net of discount | — | | | 15,000 | |

| Principal repayments of long-term debt | (1,500) | | | (625) | |

| Payments made on facility financing lease obligation and capital lease | (141) | | | (36) | |

| Proceeds from employee stock purchase plan | 570 | | | — | |

| Net cash (used in) provided by financing activities | (24,199) | | | 14,339 | |

| Effects of exchange rate changes on cash | 7 | | | (72) | |

| Net increase in cash, and restricted cash | 11,491 | | | 52,047 | |

| Cash, beginning of period | 236,184 | | | 24,700 | |

| Cash, end of period | $ | 247,675 | | | $ | 76,747 | |

| Supplemental cash flow information | | | |

| Cash paid for interest | $ | 7,947 | | | $ | 6,236 | |

| Cash paid for income taxes | $ | 2,725 | | | $ | — | |

| Supplemental disclosures of non-cash investing and financing activities | | | |

| Property and equipment included in accounts payable and accrued expenses | $ | 1,415 | | | $ | 581 | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of the condensed consolidated financial statements

MARAVAI LIFESCIENCES HOLDINGS, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1.Organization and Significant Accounting Policies

Description of Business

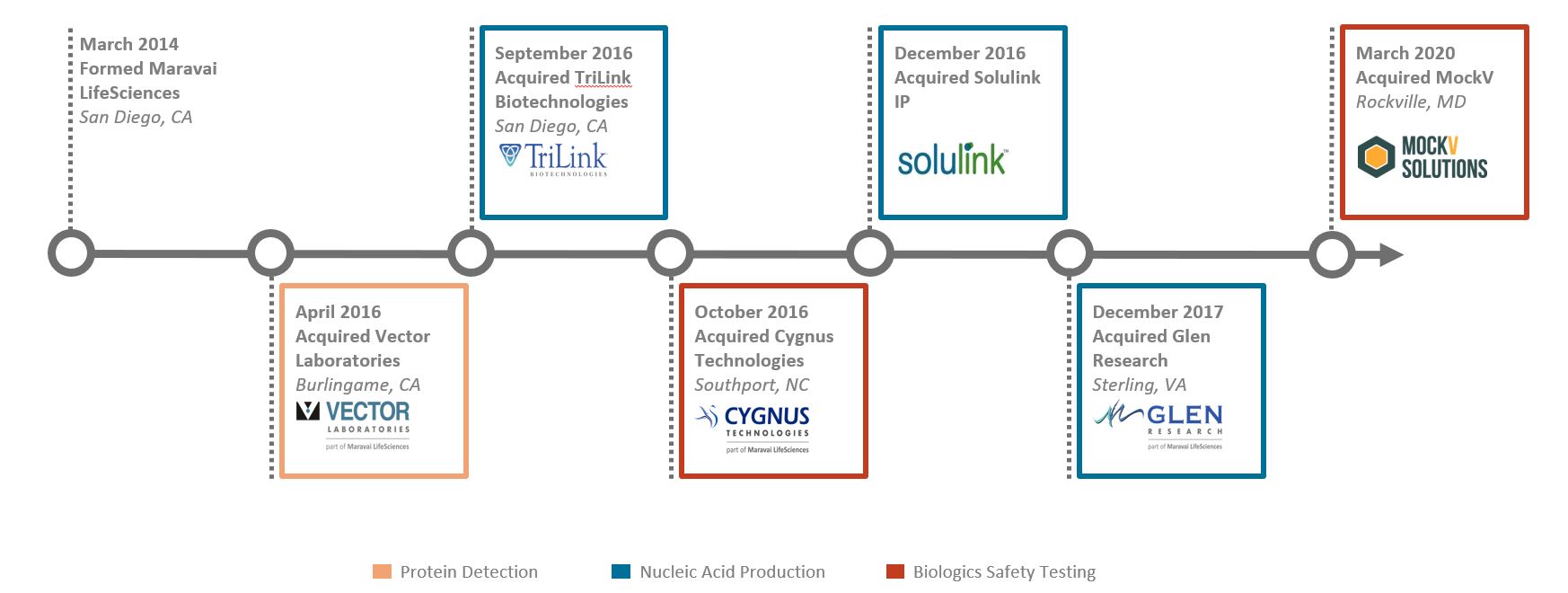

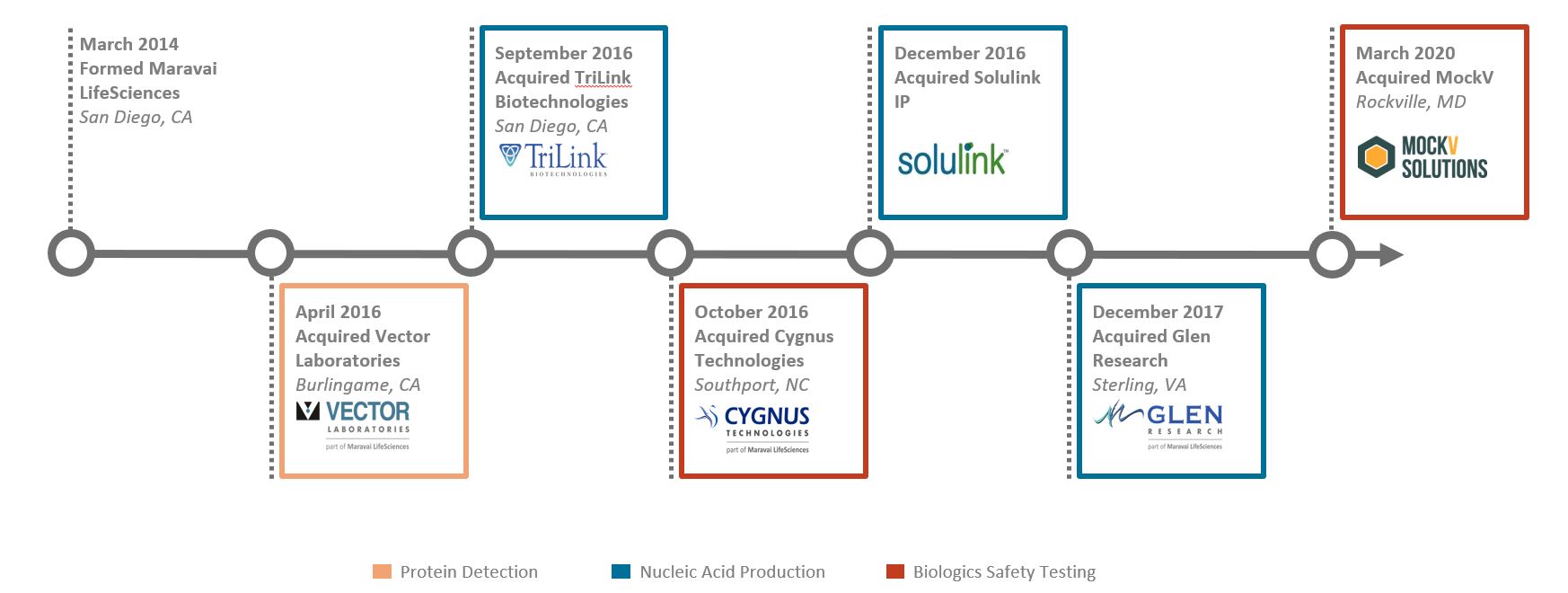

Maravai LifeSciences Holdings, Inc. (the “Company”, and together with its consolidated subsidiaries, “Maravai”, “we”, “us”, “our”) was formed as a Delaware corporation in August 2020 for the purpose of facilitating an initial public offering (“IPO”) of its Class A common stock, facilitating certain organizational transactions and to operate the business of Maravai Topco Holdings, LLC (“Topco LLC”) and its consolidated subsidiaries.

We are a leading life sciences company providing critical products to enable the development of drug therapies, diagnostics, novel vaccines and support research on human diseases. Our products address the key phases of biopharmaceutical development and include complex nucleic acids for diagnostic and therapeutic applications, antibody-based products to detect impurities during the production of biopharmaceutical products, and products to detect the expression of proteins in tissues of various species.

The Company is headquartered in San Diego, California and has three principal businesses: Nucleic Acid Production, Biologics Safety Testing, and Protein Detection. Our Nucleic Acid Production business manufactures and sells products used in the fields of gene therapy, vaccines, nucleoside chemistry, oligonucleotide therapy and molecular diagnostics, including reagents used in the chemical synthesis, modification, labelling and purification of deoxyribonucleic acid (“DNA”) and ribonucleic acid (“RNA”). Our core Nucleic Acid Production offerings include messenger ribonucleic acid (“mRNA”), long and short oligonucleotides, our proprietary CleanCap® capping technology and oligonucleotide building blocks. Our Biologics Safety Testing business sells highly specialized analytical products for use in biologic manufacturing process development, including custom product-specific development antibody and assay development services. Our Protein Detection business sells innovative labeling and detection reagents for researchers in immunohistochemistry.

Organizational Transactions and Initial Public Offering

In November 2020, the Company completed its initial public offering (“IPO”) and sold 69,000,000 shares of Class A common stock at a public offering price of $27.00 per share and received proceeds of $1.8 billion, net of underwriting discounts and commissions, which the Company used to purchase previously-issued and newly-issued LLC units in Topco LLC, to pay Maravai Life Sciences Holdings 2, LLC (“MLSH 2”) as consideration for certain organizational transactions that occurred before the IPO, and to purchase outstanding shares of Class A common stock from MLSH 2.

Immediately prior to, and in connection with, the completion of our IPO, the Company completed a series of organizational transactions (“Organizational Transactions”), including:

•The amendment and restatement of Topco LLC’s operating agreement (the “New LLC Operating Agreement”) to, among other things, (i) modify Topco LLC’s capital structure by replacing the membership interests held by Topco LLC’s existing owners with a new class of Topco LLC units (the “LLC Units”) and (ii) appoint the Company as the sole managing member of Topco LLC;

•Amend and restate the Company’s certificate of incorporation to among other things, authorize the Company to issue two classes of common stock: Class A common stock and Class B common stock;

•The issuance of shares of the Company’s Class B common stock to Maravai Life Sciences Holdings, LLC (“MLSH 1”), which was Topco LLC’s pre-IPO owner on a one-to-one basis with the number of LLC Units owned; and

•The acquisition, by merger, of two members of Topco LLC (“the Blocker Entities”), for which we issued shares of Class A common stock and paid cash as consideration (“the Blocker Mergers”).

The Company is the sole managing member of Topco LLC, which operates and controls TriLink Biotechnologies, LLC, Glen Research, LLC, Vector Laboratories, Inc., MockV Solutions, LLC and Cygnus Technologies, LLC (“Cygnus”) and their respective subsidiaries. MLSH 1 is the only other member of Topco LLC.

The Organizational Transactions were considered transactions between entities under common control. As a result, the consolidated financial statements for periods prior to the IPO and the Organizational Transactions have been adjusted to combine the previously separate entities for presentation purposes.

Basis of Presentation

The Company operates and controls all of the business and affairs of Topco LLC, and through Topco LLC and its subsidiaries, conducts its business. Because we manage and operate the business and control the strategic decisions and day-to-day operations of Topco LLC and also have a substantial financial interest in Topco LLC, we consolidate the financial results of Topco LLC, and a portion of our net income is allocated to the non-controlling interests in Topco LLC held by MLSH 1.

The accompanying unaudited interim condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany transactions and accounts between the businesses comprising the Company have been eliminated in the accompanying consolidated financial statements.

Unaudited Interim Condensed Consolidated Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and pursuant to Form 10-Q of Regulation S-X of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. These unaudited condensed consolidated financial statements include all adjustments necessary to fairly state the financial position and the results of our operations and cash flows for interim periods in accordance with GAAP. All such adjustments are of a normal, recurring nature. Operating results for the three months ended March 31, 2021 are not necessarily indicative of the results that may be expected for the year ending December 31, 2021 or for any future period.

The condensed consolidated balance sheet presented as of December 31, 2020, has been derived from the audited consolidated financial statements as of that date. The condensed consolidated financial statements and notes are presented as permitted by Form 10-Q and do not contain all information that is included in the annual financial statements and notes thereto of the Company. The condensed consolidated financial statements and notes included in this report should be read in conjunction with the 2020 financial statements and notes included in the Company’s Annual Report on Form 10-K filed with the SEC.

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires the Company to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities, equity, revenue and expenses, and related disclosures. These estimates form the basis for judgments the Company makes about the carrying values of assets and liabilities that are not readily apparent from other sources. The Company bases its estimates and judgments on historical experience and on various other assumptions that the Company believes are reasonable under the circumstances. These estimates are based on management’s knowledge about current events and expectations about actions the Company may undertake in the future. Significant estimates include, but are not limited to, revenue recognition, the net realizable value of inventory, expected future cash flows including growth rates, discount rates, terminal values and other assumptions and estimates used to evaluate the recoverability of long-lived assets, estimated fair values of intangible assets and goodwill, the payable to related parties pursuant to the Tax Receivable Agreement (“TRA”), amortization methods and periods, the fair value of leased buildings and other assumptions associated with lease financing transactions, the estimated fair value of our long-term debt, equity-based compensation, the valuation of incentive units, allowance for doubtful accounts, and accounting for income taxes and assessment of valuation allowances. Actual results could differ materially from those estimates.

Significant Accounting Policies

A description of the Company’s significant accounting policies is included in the audited financial statements within its Annual Report on Form 10-K for the year ended December 31, 2020. There have been no material changes in the Company’s significant accounting policies during the three months ended March 31, 2021.

Revenue Recognition

The Company generates revenue from the sale of products and services and the performance of services in the fields of nucleic acid production, biologics safety testing, and protein detection. Revenue is recognized when control of promised goods or services is transferred to a customer in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To determine revenue recognition for its arrangements with customers, the Company performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the entity satisfies a performance obligation. The majority of the Company’s contracts include only one performance obligation. A performance obligation is a promise in a contract to transfer a distinct good or

service to the customer and is defined as the unit of account for revenue recognition. The Company also recognizes revenue from other contracts that may include a combination of products and services, the provision of solely services, or from license fee arrangements which may be associated with the delivery of product. Where there is a combination of products and services, the Company accounts for the promises as individual performance obligations if they are concluded to be distinct. Performance obligations are considered distinct if they are both capable of being distinct and distinct within the context of the contract. In determining whether performance obligations meet the criteria for being distinct, the Company considers a number of factors, such as the degree of interrelation and interdependence between obligations, and whether or not the good or service significantly modifies or transforms another good or service in the contract. As a practical expedient, we do not adjust the transaction price for the effects of a significant financing component if, at contract inception, the period between customer payment and the transfer of goods or services is expected to be one year or less. Contracts with customers are evaluated on a contract-by-contract basis as contracts may include multiple types of goods and services as described below.

Revenue for an individual contract is recognized at the related transaction price, which is the amount the Company expects to be entitled to in exchange for transferring the products and/or services. The transaction price for product sales is calculated at the contracted product selling price. The transaction price for a contract with multiple performance obligations is allocated to the separate performance obligations on a relative standalone selling price basis. Standalone selling prices for products are determined based on the prices charged to customers, which are directly observable. Standalone selling price of services are mostly based on time and materials. Generally, payments from customers are due when goods and services are transferred. As most contracts contain a single performance obligation, the transaction price is representative of the standalone selling price charged to customers. Revenue is recognized only to the extent that it is probable that a significant reversal of the cumulative amount recognized will not occur in future periods. Variable consideration has not been material to our consolidated financial statements.

The Company accepts returns only if the products do not meet customer specifications and historically, the Company’s volume of product returns has not been significant. Further, no warranties are provided for promised goods and services other than assurance type warranties.

The Company has elected the practical exemption to not disclose the unfulfilled performance obligations for contracts with an original length of one year or less. The Company had no material unfulfilled performance obligations for contracts with an original length greater than one year for any period presented.

Nucleic Acid Production

Nucleic Acid Production revenue is generated from the manufacture and sale of highly modified, complex nucleic acids products to support the needs of our of customers’ research, therapeutic and vaccine programs. The primary offering of products include; CleanCap®, mRNA, and specialized oligonucleotides. Contracts typically consist of a single performance obligation. We also sell nucleic acid products for labeling and detecting proteins in cells and tissue samples research. The Company recognizes revenue from these products in the period in which the performance obligation is satisfied by transferring control to the customer. Revenue for nucleic acid catalog products is recognized at a single point in time, generally upon shipment to the customer. Revenue for contracts for certain custom nucleic acid products, with an enforceable right to payment and a reasonable margin for work performed to date, is recognized over time, based on a cost-to-cost input method over the manufacturing period.

Biologics Safety Testing

The Company’s Biologics Safety Testing revenue is associated with the sale of bioprocess impurity detection kit products. We also enter into contracts that include custom antibody development, assay development and antibody affinity extraction services. These products and services enable the detection of impurities that occur in the manufacturing of biologic drugs and other therapeutics. The Company recognizes revenue from the sale of bioprocess impurity detection kits in the period in which the performance obligation is satisfied by transferring control to the customer. Custom antibody development contracts consist of a single performance obligation, typically with an enforceable right to payment and a reasonable margin for work performed to date. Revenue is recognized over time based on a cost-to-cost input method over the contract term. Where an enforceable right to payment does not exist, revenue is recognized at a point in time when control is transferred to the customer. Assay development service contracts consist of a single performance obligation, revenue is recognized at a point in time when a successful antigen test and report is provided to the customer. Affinity extraction services, which generally occur over a short period of time, consist of a single performance obligation to perform the extraction service and provide a summary report to the customer. Revenue is recognized either over time or at a point in time depending on contractual payment terms with the customer.

Protein Detection

The Company also manufactures and sells protein labeling and detection reagents to customers that are used for basic research and development. The contracts to sell these catalog products consist of a single performance obligation to deliver the reagent products. Revenue from these contracts is recognized at a point in time, generally upon shipment of the final product to the customer.

Sales taxes

Sales taxes collected by the Company are not included in the transaction price as revenue as they are ultimately remitted to a governmental authority.

Shipping and handling costs

Shipping and handling costs, which are charged to customers, are included in revenue and is recognized at the same time that the related product revenue is recognized.

Contract costs

The Company recognizes the incremental costs of obtaining contracts as an expense when incurred when the amortization period of the assets that otherwise would have been recognized is one year or less. These costs are included in sales and marketing and general and administrative expenses. The costs to fulfill the contracts are determined to be immaterial and are recognized as an expense when incurred.

Contract balances

Contract assets are generated when contractual billing schedules differ from revenue recognition timing and the Company records a contract receivable when it has an unconditional right to consideration. Contract assets balances, which are included in prepaid and other current assets, totaled $1.0 million and $0.2 million as of March 31, 2021 and December 31, 2020, respectively.

Contract liabilities include billings in excess of revenue recognized, such as customer deposits and deferred revenue. Customer deposits, which are included in accrued expenses, are recorded when cash payments are received or due in advance of performance. Deferred revenue is recorded when the Company has unsatisfied performance obligations. Total contract liabilities were $120.7 million and $79.2 million as of March 31, 2021 and December 31, 2020, respectively. Contract liabilities are expected to be recognized into revenue within the next twelve months.

Disaggregation of Revenue

The following tables summarize the revenue by segment and region for the periods presented (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2021 | | Nucleic Acid

Production | | Biologics

Safety

Testing | | Protein

Detection | | Total |

| North America | | $ | 68,132 | | $ | 6,412 | | $ | 3,752 | | $ | 78,296 |

| Europe, the Middle East and Africa | | 47,898 | | 4,349 | | 1,468 | | 53,715 |

| Asia Pacific | | 7,885 | | 6,735 | | 1,360 | | 15,980 |

| Latin and Central America | | 17 | | 153 | | 50 | | 220 |

| Total revenue | | $ | 123,932 | | $ | 17,649 | | $ | 6,630 | | $ | 148,211 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2020 | | Nucleic Acid

Production | | Biologics

Safety

Testing | | Protein

Detection | | Total |

| North America | | $ | 24,869 | | $ | 5,125 | | $ | 3,429 | | $ | 33,423 |

| Europe, the Middle East and Africa | | 2,049 | | 3,541 | | 1,622 | | 7,212 |

| Asia Pacific | | 3,558 | | 5,562 | | 1,107 | | 10,227 |

| Latin and Central America | | 13 | | 66 | | 40 | | 119 |

| Total revenue | | $ | 30,489 | | $ | 14,294 | | $ | 6,198 | | $ | 50,981 |

The following table provides a disaggregation of revenue based on the pattern of revenue recognition (in thousands):

| | | | | | | | | | | | | | |

| | For the three months ended March 31, |

| | 2021 | | 2020 |

| Revenue recognized at a point in time | | $ | 136,231 | | | $ | 49,775 | |

| Revenue recognized over time | | 11,980 | | | 1,206 | |

| Total revenue | | $ | 148,211 | | | $ | 50,981 | |

Non-Controlling Interests

Non-controlling interests represent the portion of profit or loss, net assets and comprehensive income of our consolidated subsidiaries that is not allocable to the Company based on our percentage of ownership of such entities. Non-controlling interests consist of the following:

•Until November, 2020 Topco LLC held a 70% ownership interest in MLSC Holdings, LLC (“MLSC”) through its consolidated subsidiaries with the remaining 30% being recorded as non-controlling interests in our consolidated financial statements. MLSC net income or loss was attributed to the non-controlling interests using an attribution method, similar to the hypothetical liquidation at book value method, based on the distribution provisions of the MLSC Amended and Restated Limited Liability Company Agreement (“MLSC LLC Agreement”). In November 2020, and before the closing of the IPO, Topco LLC repurchased all of the outstanding non-controlling interests in MLSC for $166.4 million.

•In November 2020, based on the Organizational Transactions described above, we became the sole managing member of Topco LLC. As of March 31, 2021, we hold approximately 38% of the outstanding LLC Units of Topco LLC, and approximately 62% of the outstanding LLC Units of Topco LLC are held by MLSH 1. Therefore, we report non-controlling interests based on LLC Units of Topco LLC held by MLSH 1 on our condensed consolidated balance sheet as of March 31, 2021. Income or loss attributed to the non-controlling interest in Topco LLC is based on the LLC Units outstanding during the period for which the income or loss is generated and is presented on the condensed consolidated statements of income and consolidated statements of comprehensive income.

MLSH 1 is entitled to exchange LLC Units, together with an equal number of shares of our Class B common stock (together referred to as “Paired Interests”), for shares of Class A common stock on a one-for-one basis or, at our election, for cash, from a substantially concurrent public offering or private sale (based on the price of our Class A common stock in such public offering or private sale). As such, future exchanges of Paired Interests by MLSH 1 will result in a change in ownership and reduce or increase the amount recorded as non-controlling interests and increase or decrease additional paid-in-capital when Topco LLC has positive or negative net assets, respectively. For the three months ended March 31, 2021, MLSH 1 did not exchange any Paired Interests. In April 2021, MLSH 1 executed an exchange of Paired Interest immediately prior to the closing of the Company’s secondary offering (see Note 11)

A distribution of $23.1 million for tax liabilities was made to MLSH 1 during the three months ended March 31, 2021. No distributions were made during the three months ended March 31, 2020.

Segment Information

The Company operates in three reportable segments. Operating segments are defined as components of an enterprise about which separate financial information is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and assessing performance. The Company’s chief operating decision maker (“CODM”), its Chief Executive Officer,

allocates resources and assesses performance based upon discrete financial information at the segment level. Substantially all of our long-lived assets are located in the United States.

Net Income per Class A Common Share/Unit Attributable to Maravai LifeSciences Holdings, Inc.

Basic net income per Class A Common share/unit attributable to Maravai LifeSciences Holdings, Inc. is computed by dividing net income attributable to us by the weighted average number of Class A Common shares/units outstanding during the period. The non-controlling interest, for historical periods prior to the IPO, is calculated pursuant to the terms of the MLSC LLC Agreement on a fully-distributed basis, taking into account the various classes of equity of MLSC, including the cumulative yields on MLSC’s preferred units. Diluted net income per Class A Common share/unit is calculated by giving effect to all potential weighted average dilutive LLC incentive units for historical periods prior to the IPO and stock options, restricted stock units, and Topco LLC Units, that together with an equal number of shares of our Class B common stock (together referred to as “Paired Interests”) are convertible into shares of our Class A Common stock, for the periods after the IPO. For historical periods prior to the IPO, the weighted average number of common units outstanding during the period and the potential dilutive common unit equivalents is determined under the two-class method. The dilutive effect of outstanding awards, if any, is reflected in diluted earnings per share/unit by application of the treasury stock method or if-converted method, as applicable. The Company reported net income attributable to Maravai LifeSciences Holdings, Inc. for the three months ended March 31, 2021 and 2020.

Fair Value of Financial Instruments

The Company defines fair value as the amount that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. The Company follows accounting guidance that has a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of the asset or liability as of the measurement date. Instruments with readily available actively quoted prices, or for which fair value can be measured from actively quoted prices in an orderly market, will generally have a higher degree of market price transparency and a lesser degree of judgment used in measuring fair value. The three levels of the hierarchy are defined as follows:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets;

Level 2—Include other inputs that are directly or indirectly observable in the marketplace; and

Level 3—Unobservable inputs which are supported by little or no market activity.

As of March 31, 2021 and December 31, 2020, the carrying value of current assets and liabilities approximates fair value due to the short maturities of these instruments. The fair values of the Company’s long-term debt approximate carrying value, excluding the effect of unamortized debt discount, as it is based on borrowing rates currently available to the Company for debt with similar terms and maturities (Level 2 inputs).

Concentration of Credit Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and accounts receivable. The Company maintains the majority of its cash balances at multiple financial institutions that management believes are of high credit-quality and financially stable. Cash is deposited with major financial institutions in excess of Federal Deposit Insurance Corporation (“FDIC”) insurance limits. The Company believes it is not exposed to significant credit risk due to the financial strength of the depository institutions in which the cash is held. The Company provides credit, in the normal course of business, to international and domestic distributors and customers, which are geographically dispersed. The Company attempts to limit its credit risk by performing ongoing credit evaluations of its customers and maintaining adequate allowances for potential credit losses.

The following table summarizes revenue from each of our customers who individually accounted for 10% or more of our total revenue or accounts receivable for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Revenue | | Accounts Receivable, net |

| | For the three months ended March 31, | | March 31, 2021 | | December 31, 2020 |

| | 2021 | | 2020 | | |

| BioNTech SE | | 22.2 | % | | * | | 32.9 | % | | * |

| Pfizer, Inc. | | 29.2 | % | | * | | 34.3 | % | | 45.1 | % |

| Sanofi | | * | | 26.0 | % | | * | | * |

| CureVac | | * | | * | | * | | 12.8 | % |

| *Less than 10% | | | | | | | | |

For the three months ended March 31, 2021, substantially all of the revenue recorded for BioNTech SE and Pfizer, Inc. was generated by our Nucleic Acid Production segment. The Company continues to experience strong revenue growth in the Nucleic Acid Production segment, driven by sales of CleanCap® related products which represent a significant portion of the Company’s total revenue in the first fiscal quarter of 2021. For the three months ended March 31, 2020, substantially all of the revenue recorded for Sanofi was generated by our Nucleic Acid Production segment.

Emerging Growth Company Status

The Company is an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards issued subsequent to the enactment of the JOBS Act, until such time as those standards apply to private companies. The Company has elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date that it (i) is no longer an emerging growth company or (ii) affirmatively and irrevocably opts out of the extended transition period provided in the JOBS Act. As a result, these condensed consolidated financial statements may not be comparable to companies that comply with the new or revised accounting pronouncements as of public company effective dates.

Recently Issued Accounting Pronouncements Not Yet Adopted

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases (“Topic 842”), which supersedes the guidance in ASC 840, Leases. The new standard, as amended by subsequent ASUs on Topic 842 and recent extensions issued by the FASB in response to COVID-19, requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight-line basis over the term of the lease. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than 12 months regardless of their classification. Leases with a term of 12 months or less will be accounted for similar to existing guidance for operating leases today. The Company plans to adopt this standard using the modified retrospective approach with a cumulative effect adjustment to retained earnings at the beginning of the period of adoption. The Company will also adopt certain practical expedients provided by Topic 842. As a result of the Company having elected the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act, and assuming the Company continues to be considered an Emerging Growth Company, Topic 842 will be effective for the Company on January 1, 2022. The Company is currently assessing its inventory of leases but has not yet determined the full effects of Topic 842 on its consolidated financial statements but does expect the adoption of Topic 842 will have a material impact on the Company’s consolidated financial statements and related notes to the recognition of right of use (“ROU”) assets and lease liabilities on the Company’s consolidated balance sheets, but it will not have a material impact on the Company’s consolidated statement of income. The adoption of Topic 842 will also result in enhanced disclosures.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments which has been subsequently amended (“ASU 2016-13”). ASU 2016-13 revises the measurement of credit losses for most financial instruments measured at amortized cost, including trade receivables, from an incurred loss methodology to an expected loss methodology which results in earlier recognition of credit losses. Under the incurred loss model, a loss is not recognized until it is probable that the loss-causing event has already occurred. The new standard introduces a forward-looking expected credit loss model that requires an estimate of the expected credit losses over the life of the instrument by considering all relevant information including historical experience, current conditions, and reasonable and supportable forecasts that affect collectability. In addition, this standard also modifies the impairment model for available-for-sale debt securities, which are measured at fair value, by eliminating the consideration for the length of time fair value has been less than amortized cost when assessing credit loss for a debt security and provides for reversals of credit losses through income upon credit improvement. As a result of the Company having elected the extended transition period for complying with new or

revised accounting standards pursuant to Section 107(b) of the JOBS Act, and assuming the Company continues to be considered an Emerging Growth Company, ASU 2016-13, will be effective for the Company on January 1, 2023, with early adoption permitted. The Company is currently assessing the impact of adopting this standard on its consolidated financial statements and disclosures.

In August 2018, the FASB issued ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract (“ASU 2018-15”). The ASU aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. This new standard also requires customers to expense the capitalized implementation costs of a hosting arrangement that is a service contract over the term of the hosting arrangement. This ASU is effective for years beginning after December 15, 2020, and interim period within annual periods beginning after December 15, 2021, with early adoption permitted. The Company has not yet determined the potential effects of this ASU on its consolidated financial statements.

In October 2018, the FASB issued ASU 2018-17, Consolidation (Topic 810): Targeted Improvements to the Related Party Guidance for Variable Interest Entities. ASU 2018-17 changes how entities evaluate decision-making fees under the variable interest entity guidance. To determine whether decision-making fees represent a variable interest, an entity considers indirect interests held through related parties under common control on a proportional basis, rather than in their entirety. This guidance is effective for fiscal years, beginning after December 15, 2020 and interim periods within fiscal years beginning after December 15, 2021, with early adoption permitted. All entities are required to apply the amendments in this ASU retrospectively with a cumulative-effect adjustment to retained earnings at the beginning of the earliest period presented. The Company is currently evaluating the impact this standard will have on its consolidated financial statements and disclosures.

In August 2020, the FASB issued ASU 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40) - Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”), which simplifies the accounting for convertible instruments, amends the guidance on derivative scope exceptions for contracts in an entity’s own equity, and modifies the guidance on diluted earnings per share calculation as a result of these changes. The standard is effective for the Company for annual reporting periods beginning after December 15, 2023. The Company is currently evaluating the impact the adoption of this standard may have on its consolidated financial statements.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848) (“Update 2020-04”), for facilitation of the effects of reference rate reform on financial reporting. This update provides optional guidance for a limited period of time to help ease the potential burden in accounting for, or recognizing the effects of, reference rate reform on financial reporting. The amendments in the guidance provide optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate form if certain criteria are met. The amendments apply to contracts, hedging relationships, and other transactions that reference London inter-bank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued because of reference rate reform. When elected, the optional expedients for contract modifications are applied consistently for all eligible contracts or eligible transactions within the relevant areas of GAAP. This guidance was effective upon issuance and may generally be applied through December 31, 2022. In January 2021, the FASB issued ASU 2021-01, Reference Rate Reform (Topic 848) to clarify that certain optional expedients and exceptions apply to modification of derivative contracts and certain hedging relationships affected by changes in the interest rates used for discounting cash flows, computing variation margin settlements, and for calculating price alignment interest. ASU 2021-01 is effective beginning on January 7, 2021 and may be applied retrospectively or prospectively to such transactions through December 31, 2022. We are currently evaluating our contracts and we do not expect that the adoption of this guidance will have a material impact on our consolidated financial statements and disclosures.

2.Goodwill and Intangible Assets

The Company’s goodwill of $224.3 million as of March 31, 2021 and December 31, 2020, represents the excess of purchase consideration over the fair value of assets acquired and liabilities assumed. As of March 31, 2021 and December 31, 2020, the Company had four reporting units, two of which are contained in the Nucleic Acid Production segment. The Company has not recognized any goodwill impairment in any of the periods presented.

The following is the Company’s goodwill by segment (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Nucleic Acid

Production | | Biologics

Safety

Testing | | Protein

Detection | | Total |

| March 31, 2021 | $ | 32,838 | | | $ | 119,928 | | | $ | 71,509 | | | $ | 224,275 | |

| December 31, 2020 | $ | 32,838 | | | $ | 119,928 | | | $ | 71,509 | | | $ | 224,275 | |

Intangible assets are being amortized on a straight-line basis, which reflects the expected pattern in which the economic benefits of the intangible assets are being obtained, over an estimated useful life ranging from 5 to 15 years.

The components of finite-lived intangible assets and accumulated amortization are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of March 31, 2021 |

| Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount | | Estimated

Useful

Life (Min) | | Weighted

Average

Remaining

Amortization

Period |

| | | (in thousands) | | | | (in years) | | (in years) |

| Trade Names | $ | 11,490 | | | $ | 5,700 | | | $ | 5,790 | | | 5 - 15 | | 6.1 |

| Patents and Developed Technology | 169,404 | | | 55,952 | | | 113,452 | | | 5 - 14 | | 9.2 |

| Customer Relationships | 83,323 | | | 29,949 | | | 53,374 | | | 10-14 | | 8.6 |

| Total | $ | 264,217 | | | $ | 91,601 | | | $ | 172,616 | | | | | 8.9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2020 |

| Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Estimated Useful Life | | Weighted Average Remaining Amortization Period |

| | | (in thousands) | | | | (in years) | | (in years) |

| Trade Names | $ | 11,490 | | | $ | 5,384 | | | $ | 6,106 | | | 5 - 15 | | 6.3 |

| Patents and Developed Technology | 169,404 | | | 52,809 | | | 116,595 | | | 5 - 14 | | 9.5 |

| Customer Relationships | 83,323 | | | 28,368 | | | 54,955 | | | 10 - 14 | | 8.8 |

| Total | $ | 264,217 | | | $ | 86,561 | | | $ | 177,656 | | | | | 9.1 |

The Company recognized $3.1 million of amortization expense from intangible assets directly linked with revenue generating activities within cost of revenue in the consolidated statement of income for the three months ended March 31, 2021 and 2020. Amortization expense for intangible assets that are not directly related to sales generating activities of $1.9 million was recorded as selling, general and administrative expenses for the three months ended March 31, 2021 and 2020.

As of March 31, 2021, the estimated future amortization expense for finite-lived intangible assets is as follows (in thousands):

| | | | | |

| 2021 (remaining nine months) | $ | 15,039 | |

| 2022 | 19,428 | |

| 2023 | 19,230 | |

| 2024 | 19,230 | |

| 2025 | 19,230 | |

| Thereafter | 80,459 | |

| Total estimated amortization expense | $ | 172,616 | |

3.Balance Sheet Components

Inventory

Inventory consists of the following (in thousands):

| | | | | | | | | | | | | | |

| | March 31, 2021 | | December 31, 2020 |

| Raw materials | | $ | 20,190 | | | $ | 11,112 | |

| Work in process | | 19,897 | | | 18,333 | |

| Finished goods | | 7,042 | | | 3,856 | |

| Total inventory | | $ | 47,129 | | | $ | 33,301 | |

4.Lease Commitments

The Company leases four facilities, including office, laboratory and manufacturing space under long-term non-cancelable operating leases. The leased facilities have initial terms of two to twelve, and two leases have multiple five-year renewal terms and the other leases having three-year and five-year renewal terms.

Rent expense for the three months ended March 31, 2021 and 2020, was approximately $1.0 million and $0.8 million, respectively. For the three months ended March 31, 2021 and 2020, reported rent expense is net of approximately $0.3 million and $0.4 million, respectively, of deferred gain being recognized over the life of the lease associated with the Company’s sale leaseback arrangement for its Burlingame, California facility.